Business travel is big business. According to Statista, UK businesses collectively spent £25.7 billion on business travel in 2022, with projections suggesting this could increase 82% to £46.8 billion by 2025.

So, if you’re not managing your business travel expenses in a tax-efficient way, your business will be feeling the strain. Thankfully, we’ve got your back.

In this blog, we'll take a closer look at managing travel expenses for work and answer the question ‘Can you claim VAT back on travel expenses?’ (hint: you can!). We’ll also explore HMRC VAT implications on mileage and subsistence expenses in detail.

Ready to get stuck in?

TD;LR

- Travel expenses include various costs during business trips, such as transportation

- RoomexPay streamlines spending, but VAT reclaims have specific requirements.

- HMRC allows VAT reclaims on business travel expenses if the travel is for business purposes, proper invoices are provided and VAT guidelines are adhered to.

- Fuel VAT reclaims depend on usage – business or personal – while VAT can only be claimed back on subsistence claims when the business pays the whole cost, not a fixed allowance.

- Professional advice ensures accurate VAT reclaiming.

What is a travel expense?

When we talk about travel expenses, we're referring to the full gamut of costs incurred during business-related trips. These expenses can include everything from transportation and accommodation to meals and incidental purchases. For example:

- Transportation costs: Fares for flights, trains, buses and taxis, car hire and fuel for company vehicles.

- Accommodation fees: This includes the cost of staying in hotels, motels, serviced apartments or any other type of lodging during business trips.

- Meal expenses: The cost of meals incurred while travelling for business purposes, including breakfast, lunch, dinner and any associated gratuities.

- Incidental purchases: Covers additional expenses such as parking fees, tolls, tips or any other necessary purchases made during the course of the business travel. These costs may vary depending on the destination and the nature of the trip.

Some travel expenses will be managed on a per diem basis – either following the standard rates set by HMRC, or rates you have agreed for your employees.

Why is it important to manage travel expenses efficiently?

The reasons are manifold; here are just three of them:

1. Helps maintain financial accountability and transparency within your company or organisation.

2. Assists business in allocating resources wisely and in line with company policies.

3. Ensures compliance with regulatory requirements, minimising the risk of financial penalties or audits.

Managing travel expenses traditionally involves your workforce travellers keeping receipts during their trips and later claiming reimbursement from you. This process is time-consuming and inefficient for both parties. Employees may face delays in receiving their fund, while finance teams sometimes find it tricky to reconcile piles of receipts for end-of-month expenses.

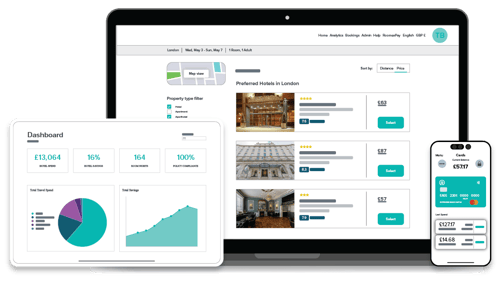

Business travel solutions like RoomexPay can help.

RoomexPay

RoomexPay simplifies on-the-road spending by giving your employees the flexibility to manage their expenses within predefined allowances. It reduces the time spent reconciling end-of-month expenses to ensure compliance, and eliminates the out-of-pocket expenses.

With RoomexPay, you can take control of your employees travel spend. But do you have to pay VAT on their business travel expenses?

Do you pay VAT on travel and subsistence?

Put simply, yes. Here’s what HMRC has to say:

“You can reclaim VAT on employee travel expenses for business trips. Travel expenses can include transport, meals and accommodation that you pay for.”

When employees travel for work or make business-related purchases, there are typically two preferred methods of payment:

- Your employees receive a per diem or a scale rate provided by the company.

- Your employees pay out of pocket and seek reimbursement later.

Reimbursement usually occurs through an expense report, where employees detail their expenses and attach receipts. Once these have been submitted to your finance team, your employees can typically expect to receive their money in the next payment cycle.

You cannot claim VAT back if you pay employees a flat rate for travel expenses.

How to claim back VAT on business travel expenses?

Employees are usually reimbursed for all business-related expenses, including VAT, which the company can then reclaim from the government. However, HMRC sets out specific requirements that you need to fulfil if you want to claim back the VAT:

- Expenses must serve company interests. So, the travel expenses you are claiming must be solely related to business purposes. This could include visiting clients, attending meetings or training courses, travelling to buy stock or to another premises or office of your company.

- You must record proper invoices, detailing VAT amounts and other relevant information, for each expense.

- All bills must be addressed to the company, not individual employees. Your workplace travellers will need to be diligent in obtaining and retaining accurate paperwork throughout their trip.

- Your company must be VAT registered.

You can also reclaim VAT on accommodation and reasonable subsistence costs for overnight trips.

Which brings us on to….

HMRC travel expenses guidelines

HMRC provides comprehensive guidelines on claiming VAT back on travel expenses.

You can find them all on the HMRC website.

Can I claim VAT back on fuel?

Yes, but only when the fuel has been used for business travel.

Working out what you can claim back and what fuel use is ineligible is complicated, especially if your employees use company cars for business and personal reasons.

Guidelines for claiming VAT on HMRC mileage claims

The method you will use to reclaim VAT on fuel depends on your business usage. If your vehicle is used solely for business purposes, you can reclaim all the VAT on fuel expenses. If your vehicle is used for both business and personal use, you have two options:

- Reclaim all the VAT and pay the appropriate fuel scale charge for your vehicle.

- Reclaim VAT only on fuel used for business trips and maintain detailed mileage records.

You may choose not to reclaim VAT if your business mileage is low, and the fuel scale charge would exceed the VAT you can reclaim.

For mileage allowance HMRC guidelines, visit the HMRC website.

What are the benefits of VAT reclaim for fuel costs?

Reclaiming VAT on business fuel expenses offers significant benefits:

- You can reclaim 100% of the VAT incurred on fuel for business purposes, provided you can prove that the fuel is used entirely for business and not for private journeys.

- Reclaiming VAT on business fuel is simplified if you also pay a VAT fuel scale charge, which is based on vehicle CO2 emissions and type.

- Alternatively, you can reclaim VAT on the business portion of fuel purchases by maintaining a detailed mileage log or using HMRC's advisory fuel rates.

- Keeping four years' worth of receipts is essential for HMRC compliance and ensuring eligibility for reclaiming VAT on mileage claims.

- Understanding these guidelines and options for reclaiming VAT on fuel expenses empowers businesses to maximise tax efficiency and ensure compliance with HMRC regulations.

What about claiming VAT on subsistence per day?

VAT can be reclaimed on subsistence expenses if the business pays the actual cost of the expense. However, VAT cannot be reclaimed when a fixed allowance is paid to your employee, even if you have tax invoices for those costs.

Understanding the regulations on subsistence allowance and maximising claims within HMRC limits is essential if you want to manage corporate travel expenses efficiently.

Regulations on subsistence allowance

HMRC scrutinises bills for accommodation, food, drinks and sundry charges to ensure appropriateness and reasonableness. So, if you’re planning to wine and dine in a Michelin-starred restaurant with top-quality champagne, you might need to think again.

Maximising subsistence claims within HMRC limits

HMRC has published scale rates for subsistence payments to employees, ensuring tax and National Insurance-free payments:

- Travels lasting 5 hours or more: The maximum claimable meal allowance is £5.

- 10 hours or more: £10 meal allowance.

- Away for 12 hours or more: £15 meal allowance.

- For a full 24-hour period or longer: Meal allowance reaches a maximum of £25.

These rates apply to travel within the United Kingdom. For international travel, businesses should consult the HMRC website for recommended allowance rates by country. By adhering to these guidelines, you can ensure compliance with HMRC regulations while maximising tax efficiency in subsistence claims.

VAT reclaims can be complicated and getting it wrong may end up being costly. We recommend you hire a professional advisor or accountant to oversee the process to make sure your VAT reclaims are ship shape.

Wrapping up

While VAT can typically be reclaimed on legitimate business-related travel expenses, you will need to adhere to HMRC regulations and keep hold of the necessary documentation to ensure you don’t face unexpected costly audits and tax bills.

If you understand those requirements, then you can maximise tax benefits and boost travel budgets for your team.

Roomex offers a comprehensive solution to streamline travel expense management, with unique benefits such as consolidating all individual stays into one invoice and providing the convenience of paying on account. This simplifies the booking process and reduces the risk of fraudulent spending and expense debt, ultimately alleviating traveller stress.

May 10, 2024