How you manage your business travel expenses is a huge factor when it comes to corporate financial health and policy compliance. Whether you’re a travel manager, finance executive or a business traveller, mastering expense reporting ensures smooth, cost-effective operations.

This guide will break down the key elements of business travel expense management, offering practical tips to streamline your processes and achieve significant savings. From understanding what qualifies as a business travel expense to leveraging the latest tools for seamless management, we’ll cover all the aspects you need to manage these expenses more effectively.

Understanding business travel expenses

When it comes to corporate travel, it's important to have a solid grasp of what qualifies as a business travel expense. In a nutshell, these are the various costs that add up during a business trip. Recognising and categorising these expenses correctly is vital for both financial tracking and staying compliant with company policies.

Key categories of business travel expenses

- Transportation: This includes flights, train tickets, car rentals and local transport like taxis and buses once at the destination.

- Accommodation: These sorts of expenses cover fees for anything from hotels and B&Bs to short-term rental properties.

- Meals and entertainment: Reasonable dining costs are typically covered, especially when you’re entertaining clients or meeting with colleagues.

- Supplies and communication: From presentation materials to internet fees, these are things you simply can’t do without when carrying out business-related tasks.

- Miscellaneous fees: Conference entry fees, client gifts or other specific costs that are needed will fall under this category.

Naturally, it's equally important to know which expenses AREN’T usually covered by company policies. These tend to include:

- Personal entertainment: Any costs for activities like sightseeing tours or event tickets that aren’t directly related to business purposes.

- Personal care: Expenses such as gym fees, laundry services or spa treatments.

- Mini-bar charges: Any items taken from a hotel’s mini-bar.

- Travel upgrades: You won’t be able to expense any non-approved upgrades, such as business class flights or luxury rental cars.

- Accompanying family expenses: It’s OK for a family member to accompany you but they’ll have to pay their own way if they aren’t with you for business purposes.

Setting clear expectations

Effective expense management starts with clear guidelines for staff. Companies need to be transparent about what is and isn't covered under their travel policy.

There are a few ways to go about this, such as:

- Setting limits on spending on meals and entertainment

- Specifying preferred vendors for travel and lodging

- Clarifying the process for submitting and documenting expenses

Providing clarification around expenses lets employees know what's expected of them, which helps to speed up the approval and reimbursement of their expenses when they come to claim them back.

The benefits of automated expense management

As businesses grow and the frequency of corporate travel increases, manually managing travel expenses becomes inefficient, time consuming and prone to errors. Automating the expense management process can significantly improve time management and financial accuracy.

Let's take a look at some of the main perks of automation:

- Reduced errors and fraud: Automated systems reduce human errors and spot fraudulent claims by enforcing company policies and limits automatically.

- Faster processing: Automation speeds up the approval and reimbursement process, reducing the turnaround time from submission to payment.

- Improved visibility: Real-time tracking of expenses allows for better budget management and financial planning.

- Employee satisfaction: Quicker reimbursements and simpler submission processes improve overall employee satisfaction and compliance.

Implementing automation tools

When choosing the right tool for expense management automation, you’ll need to take a few considerations into account:

- Integration capabilities: The tool should easily integrate with your existing financial systems, HR platforms and travel booking tools to streamline data flows and maintain consistency.

- User-friendliness: If you want people to feel happy using the tool, it must be easy to use, regardless of how tech-savvy they are.

- Customisation options: It’s important to be able to customise workflows, policies and features to fit your unique business needs.

- Support and security: Reliable customer support and strong security measures are essential for protecting sensitive financial data.

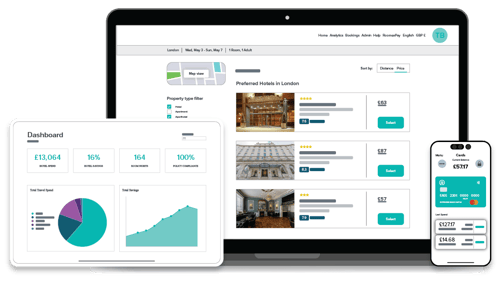

Popular tools that meet these criteria often include features like mobile apps for on-the-go expense recording and receipt scanning, automated policy enforcement and detailed reporting dashboards.

Making the switch to an automated system

Transitioning to an automated expense management system can represent a significant change for your organisation, so how to reduce the chances of bumps in the road? Here are a few ways to establish a smooth implementation:

- Communicate the change: Inform all employees well in advance about the new system, explaining the benefits and providing training on how to use it.

- Phase the implementation: Start with a pilot group of users before rolling out the system company-wide to address any issues and gather feedback.

- Monitor and adjust: Continuously monitor the system’s performance and user feedback to make necessary adjustments and finetune the process.

Creating an effective expense policy

A well-crafted expense policy sets clear expectations and guidelines for employees, reduces misunderstandings and – importantly – helps safeguard the company against fraudulent claims.

Let’s look at the essential elements of a solid expense policy:

- Clear definitions: Be sure to specify what counts as reimbursable expenses and what doesn’t. Clearly outline the categories of allowable expenses such as travel, meals, lodging and entertainment.

- Spending limits: Establish daily or per-item spending limits so that expenses stay within reasonable bounds.

- Approval process: Define who is responsible for approving expenses and the steps required for submission and reimbursement. This might include immediate supervisors, the finance department or automated approvals for certain expense types.

- Documentation requirements: Request detailed receipts and documentation for all expenditures. For smaller expenses where receipts might not be available, set a minimal threshold below which receipts are not required.

- Compliance and disciplinary measures: Let employees know about the consequences of violating the policy to emphasise the importance of adherence and maintaining fiscal discipline.

Here are a few best practices for implementing and maintaining your expense policy:

- Regular updates: Review and update the policy regularly to reflect any changes in tax laws, company goals or travel patterns.

- Training and communication: Keep employees informed about the expense policy through regular training sessions and accessible resources. Consider creating a user-friendly summary or FAQ document that addresses common scenarios.

- Feedback opportunities: Encourage employees to provide feedback on the expense policy. This can help identify pain points and areas for improvement.

- Technology integration: Utilise expense management software that aligns with your policy to automate enforcement and reduce the administrative burden.

The role of technology in policy compliance

Incorporating technology can really boost how well your expense policy works. Modern expense management tools can automatically check if expenses follow the rules, flag any that don’t, and offer detailed reports to spot trends and potential issues. This will speed up approvals and also add a level of transparency and accountability that you just can’t achieve with manual processes.

Having a clear expense policy and the right tech to support it can help companies better control spending and keep everyone following the rules. It also creates a more accountable and transparent system for managing expenses.

How to calculate travel allowances

Travel allowances play a huge role in managing business travel expenses. They cover the everyday costs employees incur while on work trips. It’s important to set clear guidelines for these allowances to keep things fair and stay on budget.

Here are the main types of travel allowances:

- Per diem allowances: These cover daily expenses such as meals and incidentals. The rates can vary depending on the destination's cost of living and the nature of the trip.

- Mileage reimbursement: Companies typically reimburse employees using their personal vehicles for business travel based on the distance travelled. Tools like the HMRC mileage calculator help to keep reimbursements accurate and conform to current tax regulations.

- Special allowances: These may include money for communication (especially if the employee is travelling internationally) or allowances for entertaining clients.

Top tools for business travel expense management:

|

Expense solution |

Benefits |

Key features |

|

Designed for businesses seeking a tailored expense solution that caters specifically to the needs of on-the-road staff. |

|

|

|

Ideal for medium to large businesses and offers extensive travel and expense integration. |

|

|

|

Great for all sizes of businesses, known for its user-friendly mobile app and receipt scanning. |

|

|

|

Suitable for small to medium-sized businesses looking for an affordable solution. |

|

|

|

Known for its ability to streamline travel processes for businesses of all sizes. |

|

Each of these tools has its own perks, which will be more or less appealing according to your business size and needs. For small businesses, a cost-effective solution like Zoho Expense may provide the necessary features without breaking the budget. Medium to large enterprises may benefit from Concur's extensive integration capabilities and powerful reporting tools.

Expensify's user-friendly interface and receipt scanning feature make it a popular choice across businesses of all sizes. Meanwhile, RoomexPay offers tailored solutions for on-the-road staff, with features like auto top-up and customisable allowances. On the other hand, TravelPerk stands out for its comprehensive services, intuitive interface and flawless expense management integration.

Picking the right solution can seriously improve your ability to handle and track travel expenses, helping you make smarter decisions and keep your finances in check.

Wrapping up

Hopefully, you’ll now have a good understanding of the ins and outs of business travel expense reporting. We've highlighted the key expense categories, explained what’s usually covered (and what’s not) and offered tips for setting clear expectations with your team. We've also shown how automating expense management can save time, reduce errors and improve compliance.

By choosing the right expense management tool tailored to your business size and needs, you can streamline your processes, increase efficiency and make smarter financial decisions.

Start implementing these strategies and tools today to keep your travel expenses in check – and your business running like clockwork.

Tags:

Finance

July 25, 2024