As we move further into 2024, business finance tools continue to evolve, placing more emphasis on efficiency and security. One of the standout innovations is the increasing use of virtual payment cards. These digital cards are essentially online versions of our traditional plastic cards but without the physical counterpart. They’re designed to be used for online purchases and over-the-phone transactions, providing businesses with a versatile tool for managing employee expenses.

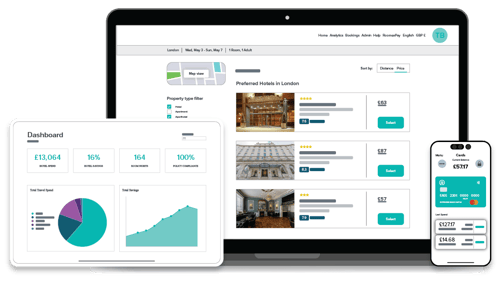

Virtual payment cards also combine the convenience of digital payments with enhanced control over spending, allowing for immediate issues, specific spending controls and complete transaction visibility. Whether you're a small startup or a large enterprise, the right virtual card can streamline your financial operations and safeguard against unauthorised transactions.

Why your business needs virtual cards

With digital agility playing a big part in business success, virtual cards represent a pivotal shift in managing corporate finances. Here are a few ways adopting virtual cards can elevate your financial operations to new levels of efficiency and security:

Empowering real-time financial management

Virtual cards offer a live view of expenditures as they happen, so that managers can make informed decisions instantly. This real-time oversight helps tighten budget controls and improve cash flow management, which is essential for fast-paced businesses.

Simplifying the expense reporting process

Integrating virtual cards with financial software automates expense reconciliation, cutting down on mistakes and admin work. Employees can focus more on their main tasks instead of dealing with complicated expense claims.

Ensuring spending policies are followed

With configurable spending limits and vendor-specific usage, transactions automatically follow company policies. This setup helps prevent unauthorised spending and makes audits easier.

Securing online purchases

Advanced security features mean that virtual cards protect your payment info by using tokens instead of actual card numbers. This extra layer of security significantly reduces the chances of fraud and data theft.

Reducing operational costs

Unlike traditional banking, which comes with various fees, virtual cards are usually more budget-friendly. They eliminate the need for multiple physical cards and can lower transaction and processing costs.

Facilitating global transactions

With multi-currency support, virtual cards are perfect for businesses working with international suppliers or clients. They make foreign transactions easier by cutting down on exchange rate fees and speeding up the process.

Using virtual cards in your business isn’t just about keeping up with trends – it’s a smart move to improve financial control, boost security and increase efficiency in all your spending. From small startups to large companies, virtual cards offer flexible solutions for today’s financial challenges and help you prepare for the future.

Let’s review our top picks for the best virtual cards of 2024, with a rundown of their key features, pricing and the unique advantages they offer to different types of businesses.

1. Revolut Business

Revolut Business is tried, tested and trusted by hundreds of thousands of businesses globally. The platform offers physical and virtual company cards you can link directly to your main business account, providing secure financial control with minimal effort.

Key features:

Real-time spending notifications, budgeting tools, unlimited virtual card issuance and support for Apple Pay and Google Pay.

Pricing:

Starts from £0 per month with basic features, with more comprehensive plans offering additional features.

Advantages:

- Supports payments in over 100 countries and 25+ currencies.

- Each employee can have up to 3 physical cards and 200 active virtual cards.

- Expenses tool allows for real-time tracking and categorisation of spending directly in-app.

Challenges:

- With multiple plans available, selecting the optimal plan might be tricky without thorough analysis and understanding of business needs.

- Customer service response times may vary.

2. Soldo

Soldo is one of Europe’s leading virtual prepaid card platforms, known for simplifying complex expense management needs. With features that support separate budgets for departments and projects, Soldo allows businesses to give controlled access to company money while safeguarding against overspending.

Key features:

Custom spending limits, real-time expense tracking, automated finance tracking and instant receipt capture.

Pricing:

Plans start at £21 per month. Offers flexible plans tailored to various business needs, with no hidden fees or fixed contracts. Plans include free unlimited domestic transactions and a fixed 1% foreign exchange fee.

Advantages:

- Set custom rules and limits for each card to prevent overspending without micromanaging every transaction.

- Integrates directly with major accounting software like Xero and QuickBooks, enabling single-click reconciliation and speeding up the month-end process.

- Soldo’s web console and mobile app provide live data on expenses, so that companies maintain complete control over their finances.

- Soldo Mastercard® is accepted by millions of merchants worldwide, providing flexibility for employee spending anywhere.

Challenges:

- You still need a regular business bank account for most of your financial needs.

- Although domestic transactions are free, international spending incurs a flat 1% fee, which might add up for businesses with significant foreign transactions.

3. Pleo

With features like adjustable spending limits and real-time spending analytics, Pleo ensures that businesses have all the tools they need to prevent overspending, avoid lost receipts and keep expense details accurate.

Key features:

Prepaid virtual debit cards with individual spending limits, real-time notifications and the ability to freeze or disable cards.

Pricing:

Offers a flexible pricing model starting at £0, making it accessible for startups and small businesses.

Advantages:

- Allows for easy adjustment of card limits and quick disabling of cards to manage spending effectively.

- All expenses are visible in real-time within the Pleo app, helping admins stay on top of the numbers throughout the duration of any project.

- Automatically syncs with accounting software, reducing the need for manual entry and making sure all expenses are captured and categorised correctly.

Challenges:

- Pleo doesn’t support cash withdrawals, which could be an issue for businesses that still require cash for certain expenditures.

- May not suit businesses looking for advanced budgeting tools.

4. Curve

Curve simplifies payments by consolidating multiple bank cards into one and provides real-time spending insights, helping businesses manage finances efficiently. You can also earn Curve Cash Points with every purchase, boosting the value of every pound, euro or dollar spent.

Key features:

Curve consolidates multiple bank cards into one and supports various digital wallets like Google Pay, Apple Pay and Samsung Pay. It also offers innovative features like the ‘Go Back in Time’ transaction switch.

Pricing:

Free basic plan with the option to upgrade to higher tiers at £9.99 or £17.99 per month for additional benefits and features.

Advantages:

- Lets you link and manage multiple debit and credit cards through a single platform, simplifying your wallet and payments.

- Provides detailed insights and notifications about spending across all connected accounts, helping you track and manage finances efficiently.

- Offers features like the ‘Go Back in Time’ function which allows changing the card used for a transaction up to 30 days later, ideal for managing budgets and expenses post-purchase.

- Earn Curve Cash Points through spending, which can be redeemed across various transactions, enhancing the value of every purchase.

Challenges:

- The free plan limits users to linking only two cards, which might be restrictive for some users.

- American Express cards can’t be used with Curve, which may be a dealbreaker for users reliant on Amex for their transactions.

- While Curve uses a near-perfect Mastercard exchange rate, the free plan does include fees for ATM withdrawals and a limit on fee-free foreign spending.

5. Moss

Moss stands out for its intelligent and flexible card solutions, which cater to modern businesses. Popular features include the ability to manage employee expenses with high-level control and simplify financial workflows with innovative credit and debit options.

Key features:

Moss provides both virtual and physical Mastercards, with instant issuance and detailed expense tracking capabilities. The system allows for real-time notifications and receipt submission.

Pricing:

Offers flexible terms with the availability of both credit and debit card options. Specific pricing details are tailored to business needs and can be adjusted based on spending limits and card types.

Advantages:

- Employees can request cards quickly and managers have the ability to approve, block or restrict usage almost immediately.

- Moss provides a real-time, detailed overview of all transactions, with digital 1:1 mapping between cards, users and merchants, increasing control over the payment process.

- Moss offers high credit limits of up to £2.5 million per month and customisable debit solutions that do not require credit underwriting.

Challenges:

- The real-time tracking and management of transactions and cards can be tricky and require constant attention, so some businesses may experience a bit of a learning curve.

6. Airwallex

Provides global payment solutions with the ability to hold, spend and manage money in over 46 currencies. Airwallex offers both virtual and physical corporate expense cards integrated with world-class security measures.

Key features:

Multi-currency support, no foreign transaction fees and the ability to issue cards globally.

Pricing:

Transparent and straightforward pricing with zero setup fees, maintenance fees or hidden charges.

Advantages:

- Operates in 40+ countries with local account details and makes transfers to over 150 countries, simplifying global financial operations.

- Manages multiple currencies easily with a global account, enjoying top FX rates to save on international payments and collections.

- Expenses come straight from a multi-currency wallet, cutting out those extra FX conversions and fees.

Challenges:

- Since Airwallex is licensed worldwide, keeping up with different international financial rules can be a bit demanding for some businesses.

7. Wise Business (formerly TransferWise)

Wise Business is extensively used by over 300,000 businesses each quarter, trusted for its ability to handle complex international financial transactions with ease.

Key features:

Wise Business lets you set up local bank details in 19 currencies, making it quicker to get paid by international customers. It also provides easy, low-cost options for international payments and currency conversions.

Pricing:

No monthly fee, with transparent costs on currency conversions and payments.

Advantages:

- Provides local account details across multiple currencies, providing quick and cost-effective receipt of international payments.

- Fees are straightforward with no hidden charges, making international payments and currency conversions predictable and affordable.

- Businesses can hold and manage funds in over 40 currencies, providing flexibility and saving on conversion fees.

Challenges:

- Free ATM withdrawals are capped at £200 per month per account, which might be limiting for businesses that need higher cash access.

- While Wise is known for transparency, the varying fee structure for different currencies and services may require careful management to optimise costs.

Wrapping up

It’s safe to say that virtual payment cards are revolutionising how businesses manage their finances. These innovative tools help keep your spending secure and efficient, reducing the hassle of month-end close and giving you better control over every transaction. If you're ready to elevate your business finances, embracing virtual payment cards could just be the smartest move you make this year.

July 25, 2024